Why CP?

Diversify risk away from traditional investments.

Leverage our strong absolute returns uncorrelated with market cycles since 1998

When positioned into a traditional investment portfolio as strategic investments, CP funds are able to provide additional diversifications. Diversification across different asset classes makes it possible to increase the consistency of returns and reduce the dependence on investments linked to stock, property and bond markets during cyclical downturns.

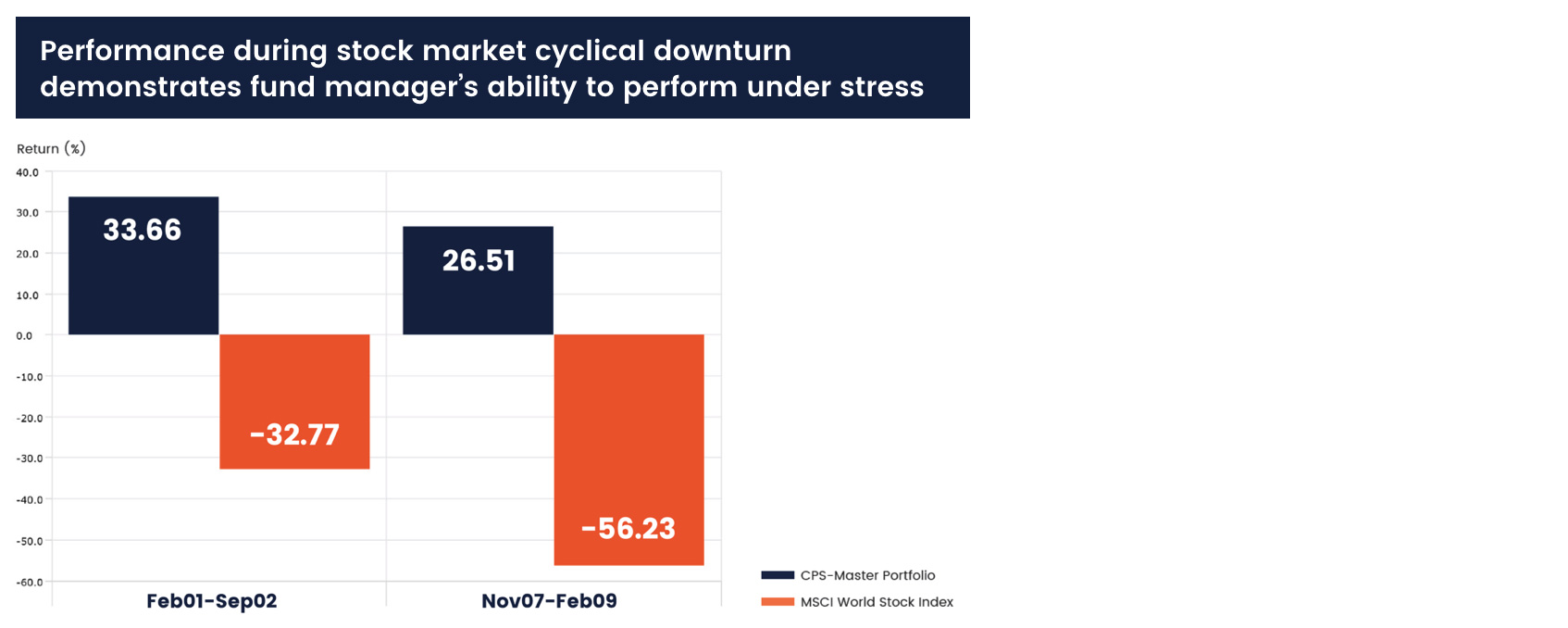

CP uses computer technology to implement a proven global macro investment approach, as demonstrated by the performance of CPS-Master Portfolio Strategy, which has outperformed all major benchmarks across two major financial crises since inception. The strength and value of this diversification is especially clear during downturns, where the strategy outperformed markets by 33.66% and 26.51% during the 2000 dot-com crisis and 2008 global financial crisis respectively.

One of the reasons this is possible is due to the combination of global macro strategy with prudent investment approach. This combination enables risks and opportunities to be constantly reassessed for identifying profits through both long and short positions, as well as rigorous hedging strategies designed to minimize losses.