Why CP?

Unlock the potential for higher risk-adjusted returns.

Leverage our proprietary CP-AI technology

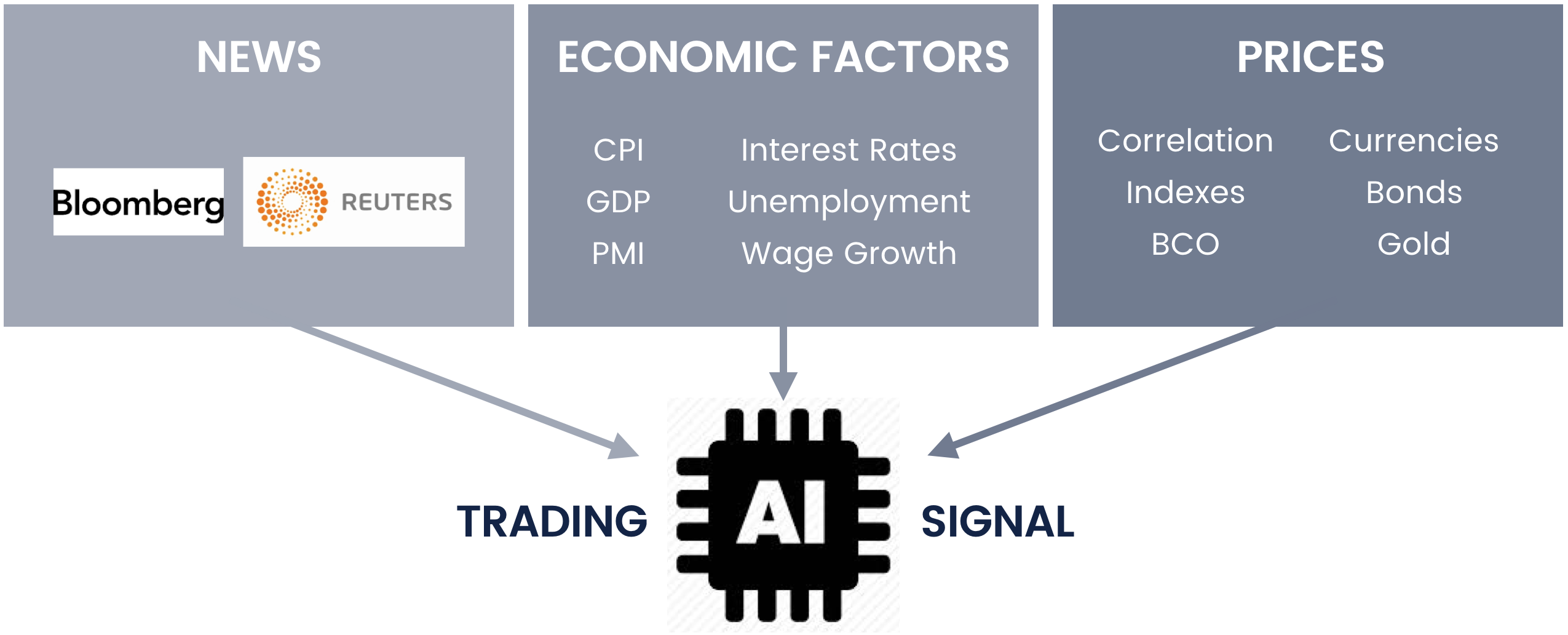

CP-AI takes advantage of the advances of computer technology in the area of big data and machine learning whilst employing the power of cloud computing to analyze large amounts of financial data.

CP-AI utilizes advanced modelling techniques such as random forests and recurrent neural networks to produce investment signals. These signals allow the Fund to take new positions or adjust existing ones.

Random forests are a computer learning method that operates by constructing a multitude of decision trees and outputting the average of the individual trees. A decision tree is a method of analysis similar to a typical step-by-step problem solving done by a human being. Random decision forests are therefore a grouping of trees, and this methodology corrects for decision trees’ habit of overfitting to their training set.

Recurrent neural networks (RNN) is a modelling technique that allows one to create an internal state of a neural network, thereby allowing it to exhibit dynamic temporal behavior, a key in time series analysis. Neural networks are a form of computer modelling and analysis that is similar to the human brain.

The design incorporates multiple time series into a recurrent neural network through an architecture called long short-term memory (LSTM). This allows CP-AI to describe the broader financial market and capture the non-linear relationships found present. This provides a broad view of the entire financial market, something that traditional statistical tools like ARIMA and GARCH struggle to deliver. Statistical tools tend to take only a single time series as input, therefore limiting the number of information dimensions available for analysis.

Further, CP-AI is developed to be smart enough to consider background context as well as forward looking factors, attempting to better replicate the CPS-Master Portfolio Strategy. For example, it does so by utilizing content interpretation techniques such as topic modelling to help discover hidden semantic structures in a text body. A topic model is a type of statistical model for discovering the abstract “topics” that occur in a collection of documents. It is a frequently used text-mining tool for discovery of hidden semantic structures in a text body. The ability to capture information from news represented in textual data typically is the missing link for traditional modelling which tends to rely solely on price factors.

This integration of investment strategy and technology development generates a refined selection of investment opportunities which allows the potential for higher risk-adjusted returns.